SUPPLY and the advent of Trump tariffs have kept lamb markets in check for now, according to the latest analysis of Elders business intelligence analyst Richard Koch.

The sheep meat market has been weighed down by heavy slaughter rates ever since the spring of 2023 when the southern season failed, and prices crashed as processors gearing up after COVID couldn’t handle the supplies thrown at them.

This experience and the ongoing mixed seasonal conditions across large lamb and sheep producing areas of southern Australia, combined with the ban on the live sheep trade in Western Australia has seen farmers downsize sheep flocks adding to sheep meat supplies.

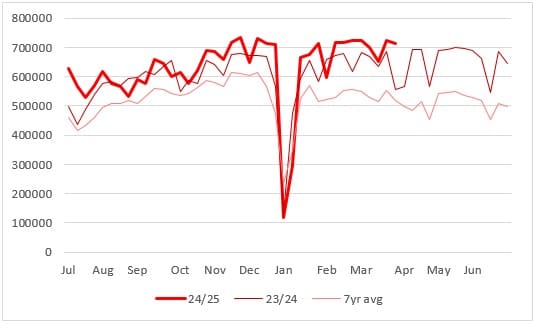

Combined sheep meat slaughter is up 5 percent on last year and 14pc on the 7-year average, mainly driven by a 23pc lift in the mutton kill year-on-year.

Chart shows combined lamb and mutton kill 24/25 vs 23/24 and 7yr average. Source – MLA.

Conservative estimates have ewe numbers back at least 20pc over the past couple of years and this combined with lower lambing percentages has consensus thinking that there will be a hole in sheep meat supplies sometime in 2025.

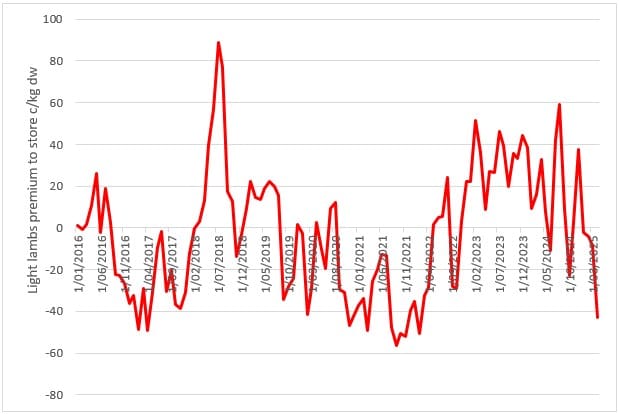

Strong prices for light lamb 14-20kg cwt ($130-$150/head) for the Middle East bag trade has seen a larger than normal number of light store type lambs go straight to slaughter rather than to restockers or feeders. Our agents report that although there are still lambs coming out of the Victoria’s Western District due to low water reserves, they are only a few lambs still left to come out of the Wimmera/Mallee, Hay, Swan Hill, Mildura and Ouyen.

This week was the first sign that numbers may be tapering with most yards reporting lower offerings and mixed quality with good heavy lambs off grain mostly selling well to above $8/kg cwt, but processors were selective on weight and type. Price trends could be best described as erratic with agents describing the market mood as nervous and apprehensive both from a producers and processors perspective due to trade uncertainty.

With seasonal conditions still tight across most sheep meat areas and the numbers of good quality types coming off pastures starting to fade, the big question is how many lambs are in feedlots, as without a season break soon, grain-fed lamb will provide the bulk of the heavyweights over late autumn-winter.

Just as numbers appear to be finally tapering, the proposed introduction of US tariffs has slowed forward sales and created a level of uncertainty about lamb pricing moving forward.

Normally the heavy export market would be red hot this time of year with buying increasing for the peak US consumption period over Greek Easter at the end of April. But while prices for lamb have been gently firming, mutton values have exploded illustrating that there is no problem with global demand for sheep meat, just that the trade is uncertain about how much they will be able to get for premium cuts that go to the US which adds value to the lamb carcase and allows a premium to be paid for heavy weight lambs.

Doubts about US market keeping export lamb prices in check

Normally, at this time of year with doubts around supply, processors would be actively looking to contract heavy lambs. Processors are still reporting export interest, but due to uncertainty around US President Donald Trump’s tariffs they are having difficulty pricing lambs forward.

We have heard several forward contracts offered around $8.60-$8.80/kg for May, but some exporters I spoke to said they couldn’t commit to a price above $8/kg because they didn’t know what price they would be selling premium lamb cuts for into the United States.

One agent offered a significant southern sheep meat export works a consistent, large supply of good heavy weight export quality lambs from the central west of NSW, but the processors could not commit to a forward price.

The US market is very important to the lamb industry because it pays a significant premium for high quality lamb cuts such as boneless legs, racks and short-loin, well above other higher volume markets such as the Middle East and China. Being a discretionary item, it’s uncertain whether the tariff could be passed onto the US consumer without affecting demand and price back to the exporter.

Steiner reports that US lamb imports were off to a strong start in late January, but have slowed down ever since. In the four weeks ending March 8 the volume of imports from Australia was 5285 tonnes (-12.7pc) compared to a year ago.

Stock losses the focus for western QLD sheep producers

Working our way around the country, our agents in western Queensland said their clients received anywhere from 120-640mm of rain and have a huge clean-up in front of them with major damage to transport and infrastructure.

Although assessments are still being made, the western QLD flock may be 25-30pc down due to flood losses with some producers losing up to 50-80pc. What sheep do survive be well down in weight and scanning percentages (50-65pc) will be low because of the season. Prior to rain the season was very tight season with ground water issues.

Merino sheep have been on a decline in the area over the last two years by 10-15pc per year with exotics replacing half of that decline and the other half just going out of sheep with some generational change.

Almost 80pc of the numbers sold out of the region go to Wagga or Forbes either to restockers or processors with very little demand from within 800-1000km. But don’t expect too many numbers to come out of this area for a while yet with the focus being on getting operational again. Our hearts go out to those affected with some Elders agents taking time off to help those affected.

Hot February sets back smaller crop of New England lambs

Moving to the northern tablelands and agents report a tough season with lamb numbers well down due to the poor season in 2023 and tough seasonal conditions at joining again in 2024.

February sown fodder crops didn’t come away due to the heat and many had to be resown on March rain and are now going gangbusters. Lambs are now moving onto crops but like last season, they will be around three months behind.

Lambs sold from the New England direct to works over the past few months were hammered by the hot February, resulting in poor yields as low as 43pc so $7.50-$8.20/kg cwt prices didn’t work out well on a per head basis. It’s hoped that the next lot of lambs going onto crop now and contracted at $8.80/kg cwt to be turned off in June/July will provide better results.

There has almost been no interest in purchasing first cross replacement ewes. Normally our agent sources large framed ewes from Narromine but for the second year in a row buying has been well down with only around five small orders about a third of normal. Northern tableland producers continue to shift into cattle.

Rain and uncertainty shrinks numbers and lifts prices

In the central west, Dubbo numbers were well off this week with good rains around and a bit of nervousness about the US tariff situation. Yardings were down by around two thirds to 6000 and prices pinged $30/head. Our agent there has done well bringing hoggets down from western QLD and has also been active in buying restocker lambs from Nyngan and Yass with Dubbo enjoying a better season than many other areas. But with the good prices for the Middle East bag trade at $130-150/hd some producers have been cashing in rather than worrying about selling to restockers or feeding them to supermarket or US export weights.

We are seeing larger numbers of mutton than usual over the past month, with some sales yarding more mutton than lambs, which is rare for Dubbo. While our season had eased recently due to a hot, dry February, fortunately over the past week we have experienced falls from 40-80mm which has got us right back on track with our season.

This chart shows the light lamb premium over store lambs since 2016. Source – MLA.

Central tablelands prices move higher in mixed quality offerings

With the season tightening up a little across the central tablelands – most areas are waiting for a follow-up rain to put some vigour into fodder crops to get some growth before winter, so offerings have been starting to taper off along with quality.

Nonetheless in an indication of concern about future supplies prices were dearer across the board this week with light lambs up to 18kgs firm at $110-145, trade types $9/hd dearer at $162-$218 and heavy weights $10 higher at $213-283, working out at $8.50-8.80/kg.

Sheep were most sought after in a mixed quality offering up $20-25 working out at between $4.80-$5.60/kg cwt which is getting up there and about the best prices since the end of 2022.

Western District running out of stock water keeps lamb numbers moving

One of our agents who looks after a big chunk of western Victoria travelled from Bendigo to Gippsland, Skipton and out to Cobar in the past week and is looking to buy lambs, reported tight conditions all the way and not many sheep or lambs. He reckons scanning rates in his main area around Bendigo were okay at 95-97pc wet with many twins and triplets.

Ramadan demand has kept the bottom end of his market firm ($7-7.30/kg Merinos or $8/kg crossbreds) 14-20/kg cwt and he has a few private feedlots who have lambs on feed, but not as many as normal.

Anything 22kg plus he can get $8-8.40/kg cwt, which is ok, but not the heady heights of pre-Christmas and a bit lower than what they normally get to over peak US demand period in the lead-up to Greek Easter.

He reckons most of his clients would be down 20pc in ewe numbers the past couple of years and he can’t sell a first cross ewe lamb to restockers having offered multiple lots at $160/hd on AuctionsPlus with no interest. Things have picked up a little after the rain, but restocking interest is still lacklustre at best.

South Australia – plenty of supplementary feeding going on

Our agents in South Australia are cleaning up the last lines of lambs with some coming out of feedlots and strong demand for sheep of all weights that sold either side of $5/kg cwt with heavier weights getting the best money. Plenty of supplementary feeding going on in areas that have started lambing. In other areas, ewes are being scanned with any dry ewes being offloaded immediately. Some clients are deciding whether to sell ewe lambs or feed on for the off-shears markets when supplies are expected to tighten later in the year.

There were some good results at Ouyen sale this week with prices up to $8/kg for Merino lambs and $8-8.40/kg for fresh trade and heavy trade crossbreds. Heavy export lambs plus 30kg worked back to $7.60-7.80/kg cwt.

Ewes scanned in lamb to British breeds across SA have moved upwards from $120-140/hd a month ago to $160-180/hd depending on age, finding new homes in the lower south-east, parts of Victoria and southern NSW.

Whilst there are some forward contracts available for processors are reluctant to commit to anything much above current pricing levels until they know exactly what’s going to happen with tariffs into the US this week.

Western Australia processing space still the issue

There has been not a lot of change in the WA market, bar the mutton side that has kicked Australia wide. Lambs still sitting at $7.40/kg cwt. Mutton is $3.80-3.90/kg cwt with quite a bit of interest coming from the East with mutton there heading to over $5/kg cwt. Our agents are looking for at least another 20-30c/kg cwt to make it a bit more attractive to truck sheep across the border with current freight costs.

Delivery for the last export boat for the season will be around the 24th of this April. That will be about 120,000-130,000 sheep removed from the state through April, so that will help.

What is not going to help the lamb job is finding processing space prior to Easter with all the public holidays. Plus, one of the major WA abattoirs had a breakdown during the week that kept them closed for two days.

Elders has its feeder lamb sale this Friday on AuctionsPlus with around 10,000 head pencilled in with strong interest from feedlotters. Seems like some of the processors with feedlots have cleared a bit of space and want to fill up yards again.

Due to the dry and lack of other options there is still a lot of lambs on feed, lambs that would normally be fed for four weeks have been on feed for seven or eight weeks now with weights starting to blow out.

Processing space is still difficult to find especially for the bigger feedlotters who have 30,000 or 40,000 head and normally contract to processors at 54kgs, but because they can’t get any large volume killed, they are tipping them out closer to 60kgs.

A buyer from over east can handle them on a week’s notice, but the problem is he is only offering a $7.60/kg cwt, so by the time we freight them, it’s back to the high $6/kg cwt mark and you lose yield, so it’s not ideal.

Our agents say that have just seen the first order for chilled air freight lamb into the Middle East for a long time, we suspect due to Qatar Airlines taking a stake in Virgin. So, there is a processor order out at $6.20/kg cwt for lambs 16-28kgs fat score 1 and 2.

Interestingly one of my industry contacts said that the cost of live sheep transport is now around $250/hd due to increased regulation and lower shipping capacity that has been cut from 80,000-100,000 to 60,000 head. Regulation has priced live sheep by sea out of the market.

Tasmania looking for rain before it gets too cold

Over in Tasmania there has been no rain of any of note over the last few weeks. They need rain soon as within a month or so it will get cold and there won’t be a lot of growth. The Tasmanian sheep meat job is relatively steady. Local trade lambs are sitting around $7.40/kg cwt and a bit of forward interest around $8/kg cwt.

Middle East bag trade lambs tops are at around $7.40/kg cwt. The physical market is probably the place to be, anywhere from $7.60-7.90/kg cwt seems to be about the mark.

And the mutton job over here is solid. Good competition after the better quality heavier types anywhere from $4.60-$5/kg cwt.

HAVE YOUR SAY