Angus Gidley-Baird.

AUSTRALIAN lamb prices are expected to increase from current levels this year underpinned by lower production, according to Rabobank.

In Rabobank’s latest Global Animal Protein Outlook, lead author, RaboResearch senior protein analyst Angus Gidley-Baird said lamb supplies are down from records, which is providing support for prices.

“After record lamb production in the first half of 2024, volumes started to recede through the second half of the year,” Mr Gidley-Baird said.

“In Q3, lamb slaughter volumes dropped four per cent year-on-year.”

He said uncertainty about how many lambs will be available in the 2024/25 season lingers in the market, but elevated sheep slaughter throughout 2023 and 2024 suggests lower availability.

However, Mr Gidley-Baird said poor seasonal conditions have prevented producers from finishing lambs within normal time frames, masking the impacts of lower breeding numbers.

“We believe there is still a volume of lambs yet to come to the market, though it is unlikely to be significant enough to translate to substantially lower lamb prices.”

RaboResearch expects lamb production in 2025 to decline from 2024 levels and prices to hold and then increase from current levels.

Mr Gidley-Baird said the lower volumes will likely also mean increased supply variability throughout the year.

Seafood to overtake chicken

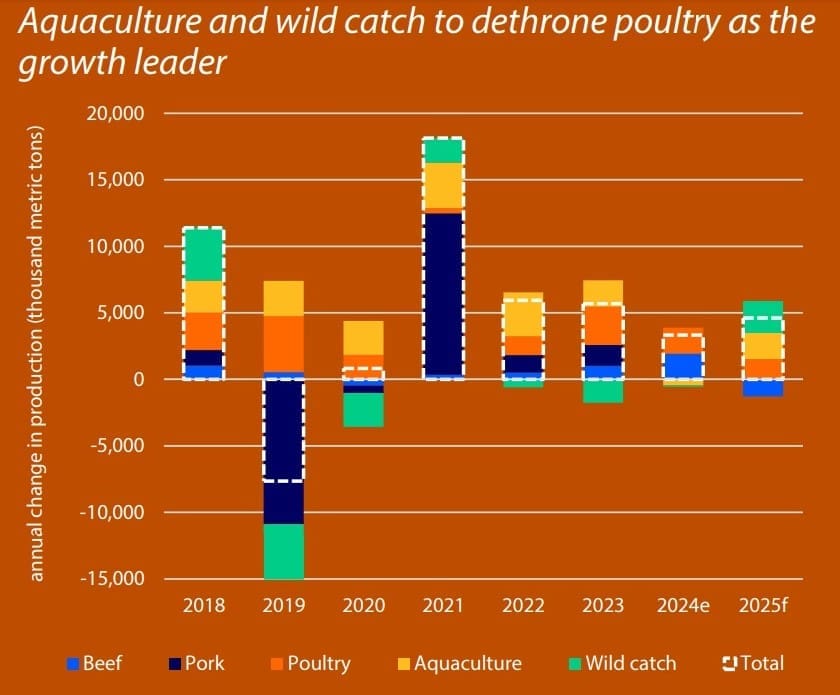

The RaboResearch report also said seafood — wild-caught and farmed – will pass chicken as the leading contributor to global protein supply growth this year.

Wild caught seafood (lime green bar) and farmed aquaculture (yellow bar) will exceed poultry growth (orange bar) on a global basis this year, the report suggests.

Global pork production (dark blue) will remain virtually unchanged, for a second consecutive year.

In contrast with other parts of the world where beef production is declining, in Australia, the bank expects beef production to remain little changed in 2025, compared with last year.

“In 2025, economic conditions, geopolitics, and supply availability will significantly influence global animal protein markets,” Mr Gidley-Baird said.

“While protein demand remains vulnerable to macro-economic fluctuations and policy changes, seafood is poised to surpass poultry as the leading contributor to global protein supply growth.”

Mr Gidley-Baird said government policy and macro-economics will shape demand and access to supply.

“As the global economy strives for recovery, anticipated policy shifts from new governments could introduce protectionist measures, leading to tariffs and higher trade costs,” he said.

“Military conflicts may further disrupt shipping and freight, impacting global trade and increasing market volatility,” he said.

“Although inflationary pressures have been easing, policy decisions could reverse this trend, potentially weakening consumer demand if incomes do not rise accordingly.”

Mr Gidley-Baird said production in many regions and species will reach a turning point, with aquaculture and wild catch leading growth.

“The year 2025 marks a pivotal moment for production across various regions and commodities. Overall production is set to grow slightly faster than in 2024, driven by aquaculture, wild caught seafood, and poultry,” he said.

Seafood and pork are expected to transition from contraction to growth, while beef will move from growth to contraction, reshaping market dynamics and supply chains.

The Rabobank report said aquaculture and wild catch are projected to grow by 2.3 percent year-on-year, rebounding from a 0.3pc decline in 2024. Poultry will continue its steady growth, while beef production will decline due to contractions in major regions other than Australia.

Pork production will be up marginally (0.1pc) after significant growth from 2021 to 2023 following recovery from African Swine Fever.

Mr Gidley-Baird noted growth in terrestrial species production will decelerate in most regions, with Brazil experiencing a 1pc contraction.

“China will see a small increase after negative growth in 2024. Oceania will maintain steady production, while the EU27+UK, North America, and Southeast Asia will face slower growth than 2024,” he said.

HAVE YOUR SAY