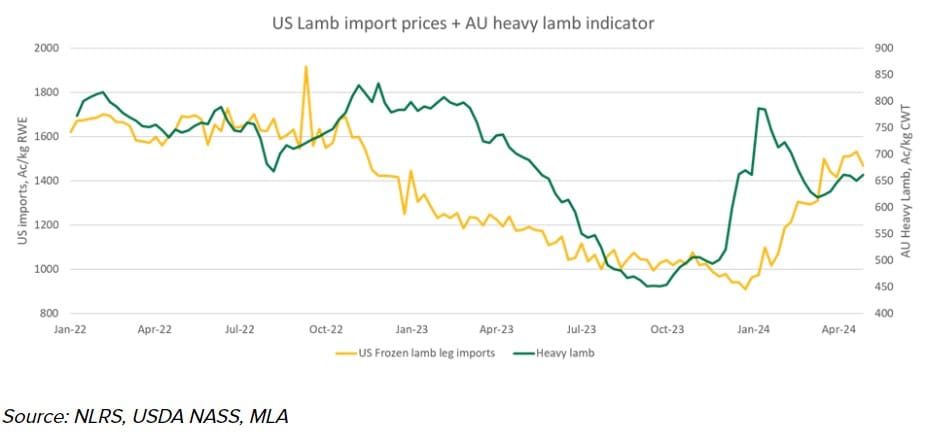

FROZEN lamb leg prices into the United States have risen 61 percent since Christmas during a period in which heavy lamb prices in Australia dropped by more than 10pc.

Meat & Livestock Australia this week said strong demand from the United States has supported heavy lamb prices.

MLA global supply analyst Tim Jackson said since December, American demand for Australian lamb has lifted very strongly.

“Just before Christmas, frozen lamb leg prices averaged A$9.09/kg wholesale, and since then have lifted a remarkable 61pc to A$14.67/kg,” he said.

“While local factors tend to have the strongest impact on prices week-to-week, demand-side factors often drive prices over the longer term, especially when a particular spec becomes associated with a particular market.”

According to the MLA website, the average price for heavy lamb hit 661c/kg on 25 December 2023, rising to 786c/kg on 5 January 2024 and falling to 683c/kg on 3 April.

Mr Jackson said the heavy lamb indicator and US imported lamb leg price are not fully correlated, “but are related, and the US price tends to influence the heavy lamb over the long-term.”

“Prices for both US lamb imports and the heavy lamb indicator began to fall in December 2022, and continued sliding throughout most of 2023.

“The fact that both indicators fell is something of a coincidence; Australian prices eased in response to expectations of dry weather, while weak consumer demand in the US drove import volumes down,” he said.

Mr Jackson said the resurgence of Australian lamb prices in October 2023 preceded the lift in US import prices by approximately three months, as east coast rains boosted market sentiment domestically, while increased prices for other proteins in the US market drove demand from January 2024 onwards.

“Since then, the robust demand for lamb in the US has supported heavy lamb prices, and the heavy lamb price began trending away from other indicators,” he said.

“Since the start of the year, the heavy lamb indicator has fallen by 16pc, while the light lamb Indicator has eased by 34pc.

“While both have eased, the relatively strong performance from heavy lamb is due in part to strong overseas pricing supporting demand, which is less evident in other parts of the market,” Mr Jackson said.

“Given the relationship between meat demand and livestock price, the strong outlook for Australian red meat in the global market is a positive indicator for producers.

“As competitor supply continues to decline and as consumer spending in most key markets retains a robust pace, Australia is well placed to meet global demand over the coming months and years.”

Source – MLA.

HAVE YOUR SAY